With only seven dispensaries, Rhode Island tops the list with nearly $17 million in annual sales revenue per store. But that will soon change.

Myriad metrics can provide indicators for the health of a state cannabis market, from overall sales to sales per capita to volume sold versus supply and to pricing points. However, the saturation of dispensary licenses often plays a significant role in the attractiveness of a state market for businesses in the space.

For single-state operators entertaining a multistate business plan—or even for multistate operators hoping to broaden their portfolio by entering new markets—it’s important to consider a state’s licensing structure before committing to a strategic expansion.

Knowing what to expect from an individual store’s projected sales revenue in any given state or region is often a defining factor for businesses analyzing potential opportunities in their targeted markets.

So, what states in the U.S. have the highest average cannabis sales per dispensary, and which states have the lowest?

With only seven retailers currently selling adult-use and medical cannabis in Rhode Island, the Ocean State has the highest rate in the nation at $16.8 million in annual sales per dispensary projected for 2024. This was calculated based on monthly sales figures from the Rhode Island Department of Business Regulation: $117.9 million in projected sales for 2024 divided by seven dispensaries equals $16.8 million.

However, Rhode Island may not be the top dog for long: The state’s Cannabis Control Commission is currently licensing two more hybrid retailers and finalizing rules to award 24 adult-use dispensary licenses required under state law passed in 2022.

That means 33 dispensaries will soon share a piece of the overall sales pie, likely lowering the average sales per store by a significant margin in Rhode Island.

RELATED: 24 Adult-Use Dispensary Licenses Still Up for Grabs in Rhode Island via Lottery

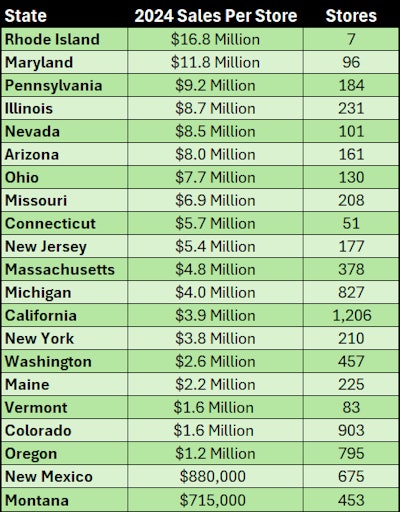

The chart below shows 2024 projections for average cannabis sales per dispensary in 21 state markets followed by additional details: Pennsylvania is the lone medical-only cannabis market included in this report. All figures were derived from state government sources.© Cannabis Business Times

Pennsylvania is the lone medical-only cannabis market included in this report. All figures were derived from state government sources.© Cannabis Business Times

While the more mature markets on this list resemble stabilized sales and dispensary numbers, the 10 states that launched adult-use sales since the beginning of 2022 are still developing markets: Connecticut, Maryland, Missouri, Montana, New Jersey, New Mexico, New York, Ohio, Rhode Island and Vermont.

These 10 states still have fluctuating dynamics regarding growing sales figures and additional dispensaries entering the marketplace at a more rapid pace than their adult-use predecessors.

For example, Maryland is near the top of the list with the average dispensary projected to ring up $11.8 million in 2024 ($1.13 billion in overall sales divided by 96 stores). However, this represents a first-mover advantage for the state’s existing medical cannabis operators who were allowed to transition to adult-use sales in July 2023.

Earlier this year, the Maryland Cannabis Administration conducted lotteries to award adult-use licenses to social equity applicants, including for 83 dispensaries. If these retailers were added to the marketplace and sales remained the same, the average store would record roughly $6.3 million in annual sales versus $11.8 million. But this hypothetical is unlikely to play out: When more dispensaries open, overall state sales figures usually climb.

Near the bottom of the list is New Mexico with the average dispensary projected to ring up less than $900,000 in 2024. However, this number is skewed low because a large portion of the roughly 675 dispensaries that were recording sales as of September 2024 appeared to still be in their start-up phases, according to monthly sales figures from the state’s Regulation and Licensing Department (NMRLD).

More than 125 New Mexico dispensaries reported less than $10,000 in sales in September 2024, according to the NMRLD. Only 140 dispensaries reported more than $100,000 in sales for the month (a $1.2 million annual rate). Notably, New Mexico regulators have issued 1,006 dispensary licenses, meaning more than 300 licensees have yet to open their stores.

But location plays a significant role in dispensary success in New Mexico—the state’s top-performing dispensary, Dark Matter Cannabis, is on pace to record $17.5 million in sales this year from its storefront in Sunland Park. While Sunland Park has a population of roughly 17,500, the city lies just across the border from El Paso, Texas, and Ciudad Juárez, Mexico. This means roughly 3 million people in cities with less permissive cannabis laws live within short driving distance.

While Sunland Park is the 14th most populated city in New Mexico, its dispensaries are on pace to sell $55 million worth of cannabis in 2024, bested only by the No. 1 populated city, Albuquerque, according to NMRLD sales figures.

New York, Ohio and New Jersey also have heavily fluctuating variables.

New York’s licensed adult-use cannabis dispensaries have continued to open by the week throughout 2024, with more than 150 retail locations opening since January. As a result, weekly sales figures continue to climb, according to the New York Office of Cannabis Management (OCM). This trend will likely continue as the state’s Cannabis Control Board approves more dispensary licenses at each month’s board meeting.

While New York regulators initially approved 463 adult-use dispensary licenses for social equity applicants as part of a Seeding Opportunity Initiative launched in 2022, the OCM opened an application window for all operators in October 2023 that drew more than 4,300 applications for dispensary licenses. Former OCM Executive Director Chris Alexander indicated in December that the board would start by awarding 250 dispensary licenses to priority applicants who already own or rent retail space. The board would then award another 500 dispensary licenses to the applicants who applied without a retail location.

New York’s Cannabis Control Board has approved more than 250 dispensary licenses from the late 2023 general licensing application window via nine award cohorts so far in 2024.

Ohio launched adult-use sales in August 2024 via roughly 130 existing medical dispensaries that received a first-mover advantage in the nonmedical market. The state’s Division of Cannabis Control also awarded licensing rights for another roughly 170 adult-use dispensaries—dubbed 10(B) dispensaries—to existing medical cannabis companies that will begin opening new stores in the coming months. In addition, Ohio will award another 50 dispensary licenses to social equity operators, as required under state law.

New Jersey, which also launched adult-use sales via existing medical dispensaries in April 2022, now has 177 operating dispensaries with more license holders being approved and opening each month. Specifically, the state’s Cannabis Regulatory Commission (CRA) had approved nearly 2,000 license applications—the majority of which were for aspiring dispensary operators—as of late June. There is no established limit on the number of cannabis business licenses available statewide, according to the CRC.

Among the 7,558 licensed dispensaries included in this report, the average store will report $3.5 million in sales revenue this year. However, a lot will change in 2025 as the nation’s 10 emerging adult-use markets continue to grow and mature.